Small & Medium Businesses Love Them So Much…

“Gross Margins More Than DOUBLED Year over Year!” (1)

Meet Logiq Inc. The Small Cap That Has e-Commerce Mega-Brands Shaking in Their Boots.

HOT NEWS

IBN (InvestorBrandNetwork) Announces Latest Episode of The Bell2Bell Podcast featuring Luis Merchan, CEO of Flora Growth Corp.

Breaking News Flash:

It’s never been easier to buy and sell. In fact, the global e-commerce market is expected to reach or exceed a staggering $6.5 trillion by 2024. (2)

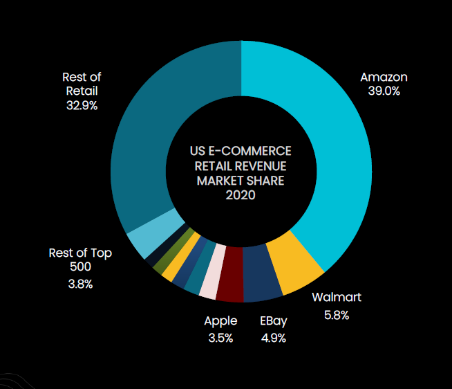

Mega-brands like Amazon, Walmart, and Apple control about 70% of the US market. (3) They can use their deep pockets to drive ad costs sky-high in order to choke out small and medium businesses.

They’ve succeeded…until now.

Logiq is breathing life back into main street thanks to their end-to-end programmatic marketing architecture. They help clients generate much better leads which they can then re-market to and generate wider margins…saving valuable time and money.

As a result LGIQ revenues are steamrolling up by 39.77%! (1)

Don’t Have Time to Read?

LGIQ CEO Brent Suen Breaks It Down

The Top 5 Reasons to Keep Your Eyes on Logiq Inc.

(OTCQX:LGIQ)

(NEO:LGIQ)

Logiq Inc. (OTCQX: LGIQ) (NEO: LGIQ) blew away 2021 Q4 earnings by almost 40%. (1)

It’s well-positioned to help small & medium-size businesses thrive in the $6.5 trillion e-commerce and mobile commerce industry.

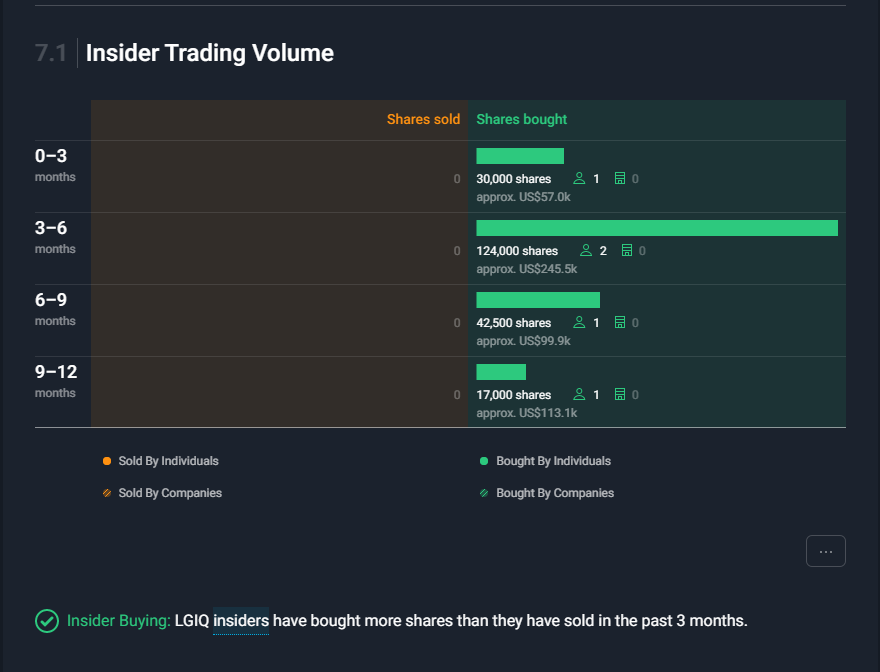

LGIQ is showing heavy insider buying. (7)

CEO Brent Suen stated the company has plans to up-list from the OTCQX Exchange to the NASDAQ. (6)

The company estimates revenue growth to reach as high as $75 million at the end of 2022. (4)

Logiq Inc.

(OTCQX:LGIQ)

(NEO:LGIQ)

Blows Away Revenues Estimates

Logiq Inc.

(OTCQX:LGIQ)

(NEO:LGIQ)

Diverse and Multifaceted Revenue Drivers

As social media continues to grow in new ways and into new platforms, the percentage of buying decisions made with social platforms in mind has increased dramatically.

However, with privacy laws that limit marketers’ ability to target ads and consumers who are better at blocking ad interruptions, it’s becoming tougher to get a decent return on advertising spend. The cost per click for paid search ads increased by 15% between the second and third quarters of 2021 alone. (17)

Even so, social platform commerce and ad buying capabilities continue to get stronger, and Logiq stands right there so buyers without the deep pockets of the big advertisers can extend that reach to programmatic channels in a much smarter way and at a lower cost.

This is just one of many reasons the company is growing at such a rapid pace. And they’re not stopping there in the effort to create the world’s best AdTech/MarTech platform for small and medium-sized businesses, both B2C and B2B.

AppLogiq B2B Platform-as-a-Service (PaaS)

AppLogiq is a subscription-based mobile commerce PaaS that aids small- to medium-sized businesses (SMBs) in marketing, auctioning, and delivering goods and services with any mobile device. This is why Logiq has positioned itself as the “Shopify of Mobile.” (9)

The brands most reliant on short-term performance marketing often struggle the most in the increasingly saturated commerce space. But with Logic’s built in attribution modeling and data-driven performance marketing, businesses can show a clear line to value from their ad spend and brand-building activities.

AppLogiq operates in regions with the world’s most active mobile users- Southeast Asia, Europe, and the U.S. (12)

The AppLogiq platform-as-a-service (PaaS) enables MSMBs worldwide to easily create and deploy a native mobile commerce app without technical knowledge or capital expense.

AppLogiq empowers businesses to reach more customers, increase transactions, process payments, manage logistics, and promote their products and services in an easy, affordable, and highly efficient way. It also empowers novice mobile marketers with easy-to-use data analytics and re-engagement/retargeting solutions. (9)

DataLogic: An AI-Powered MarTech Platform for Any Size e-Commerce Business

Logiq’s DataLogic service is a MarTech and AI-Powered Big Data platform for enterprises and brands. In other words, this is a consumer monetization platform that connects providers with brands and provides connections for buyers and sellers of consumer data. (8)

DataLogiq’s strong growth is forecasted to be offset by economic effects from CV-19 on subscription revenues. A majority of the platform’s distributors and customers operate in Indonesia, which has witnessed some of the strictest lockdowns in the world. (14)

Logiq recently partnered with Peer39 to provide small and medium-sized businesses, and the agencies that serve them, with the industry’s largest and most scaled pre-bid keyword, contextual and brand safety solutions for modern marketers. (15)

Logiq Inc. Technology Includes the Power of the Blockchain

In early 2021 Logiq made a very savvy strategic acquisition in Rebel AI. (16) This technology works to simplify the digital media trading ecosystem through strategic, streamlined technology products.

It’ss based on specific blockchain components, including identity, consensus, and currency.

Logiq now owns this patent-pending technology that can create a unique, immutable identity for every publisher, completely eliminating domain spoofing, and creating the wallets that will facilitate the future of media trading.

If you didn’t know, click and domain spoofing is a VERY big problem in digital advertising.

Bottom line? Through this simplified, easy-to-use platform, marketers will be able to advertise across popular websites and connected TV media destinations to attract more consumers to their online stores.

Coupled with advanced audience targeting, artificial intelligence algorithms and blockchain-based security, this platform will lower the costs of customer acquisition.

Just another reason the mega-brands are being put on notice by Logiq!

Logiq Inc. : Strategic Partnerships and Strong Growth

(OTCQX:LGIQ)

(NEO:LGIQ)

Logiq recently partnered with Shopee, the leading online shopping platform in Southeast Asia and subsidiary of publicly traded Sea Ltd. (11)

Logiq also announced an integration of GoLogiq with the ShopeePay mobile payment platform. (11)

With ShopeePay’s ascension in the market, GoLogiq’s platform is forecasted to grow even further. In its most recent quarter, ShopeePay processed 260 million financial transactions- an increase of approximately 130% year-over-year, with a revenue increase of approximately 187% to a record $510.6 million. (13)

Logiq also joined forces with Yabx, the microfinance unit of $5.2 billion Tech Mahindra. (10)

Strong Leadership, Strong Results

(OTCQX:LGIQ)

(NEO:LGIQ)

The most successful companies usually possess a strong management team and Independent Board of Directors. Logiq Inc. certainly has that covered.

MR. BRENT SUEN, Chief Executive Officer & Executive Chairman

Mr. Suen has 31 years of experience in the capital markets / investment banking industry. He was the youngest hire at Bear Stearns merger arbitrage department in 1987. He also has significant experience with Telecom, Media and Technology (TMT) companies as both investor and advisor. Brent has significant operational experience with both start-ups and expansion stage companies in Silicon Valley during the 1990’s, emerging markets experience in Asia, Eastern Europe and Latin America, and more recently mobile and internet companies in Southeast Asia.

MR. JOHN MACNEIL, Chief Operating Officer & Director

Mr. MacNeil has established extensive experience in the both financial services and technology industries over the course of a thirty year career. From 2008 to present, Mr. MacNeil advised technology, financial technology and renewable energy companies on strategic relationships, financial forecasting, investor relations and capital formation. He was a portfolio manager for technology funds at Schroders Investment Management from 1999-2008. He holds an MBA from Columbia Business School, as well as a BSEE from University of Connecticut.

MR. LIONEL CHOONG, Chief Financial Officer & Director

Mr. Choong has had over 30 years of experience in finance across a number of fields, such as ‘Big 4’ audit, compliance and chief financial officer. He was former vice chairman of Emerson Radio (NYSE: MSN). He was also the former Chief Financial Officer of Byford London, listed on the Hong Kong Stock Exchange. Lionel is a chartered accountant & retired as a partner of Deloitte where he headed up the biz development for Corporate finance service lines. He has an MBA from Kellogg-HKUST and a Corporate Finance Diploma from the Institute of Chartered Accountants in England & Wales, UK.

MR. MATTHEW BURLAGE, Director

Matt has spent the last three decades involved in financing and advising Asia’s leading corporations, government enterprises and financial institutions and has been involved in some of the most groundbreaking transactions in Asia, particularly in the telecom,media and technology (TMT) sectors. In 2000, Matt co-founded IRG, a boutique financial advisory and investment firm focused on the core growth sectors in Asia. Matt advisesAsian and global corporates, private equity funds, hedge funds and sovereign wealth funds on a range of transactions including mergers, acquisitions, corporate restructurings, and debt capital and equity capital financings. Matt is also responsible for the firm’s investment strategy and management of its proprietary capital. Before co-founding IRG, Matt was a Managing Director and Head of Industry Groups at LehmanBrothers in Hong Kong. Matt has a MBA from Harvard Business School and a Bachelor ofArts from Yale University, and attended the Japanese Language Institute of SophiaUniversity.

MS. LEA HICKMAN, Director

Lea is a seasoned technology product strategist with more than 25 years’ experience building and executing go-to-market strategies. She brings to Logiq an extensive record in successful strategy execution while serving in several senior level positions at top technology companies.

She presently serves as a partner at Silicon Valley Product Group, a global product consulting firm where she advises major tech companies and executives. She was previously vice president of product at InVision, a digital product design platform for creating superior customer experiences. She was responsible for establishing the product management structure and best practices for the collaborative design platform.

MR. ROSS O’BRIEN, Director

Ross is an analyst, writer, presenter, and consultant focused on the economies and business environments of the Asia-Pacific, with over 25 years of experience in the region. His analysis surrounds Asia’s Innovation Economy—the intersection of information technology and the region’s broader society and economy. For nine years he was Director of the Economist Corporate Network. Currently, and beginning in 2003,Ross was Managing Director of the Hong Kong operations of Intercedent Asia, a region-wide partnership of B2B market consultants, which provides research based market entry and positioning advice in several verticals across Asia. Ross’ practice focuses on market entry strategies for telecoms and IT companies, in managed services and wireless solutions. His client work involved extensive research work in over a dozen economies in Asia, including extended field research in China, Indonesia, Vietnam andBangladesh. Ross has an AB in Asian Studies and Anthropology from Dartmouth College(1989), and an MBA from the University of California at Berkeley’s Haas School (1996).He is conversant and literate in Mandarin and Indonesian.

MR. BRETT LAY, Director

Currently President of RTI Network, an undersea cable operator funded by Google, NEC and other Fortune 500 companies. Over 18 years of work experience in Asia while residing in Singapore and Hong Kong. Active member of the board of directors for joint ventures in China, India, South Korea, and Philippines. Originated and completed the successful execution of several mergers and acquisitions, including the post integration efforts. A company officer in diverse sized organizations including; a large corporation (NYSE $62 billion), a startup company taking it from an idea to now a component of a $33 billion NASDAQ public company, and recently completed the sale of Pacnet to Telstra. Created multiple financing programs including equity origination, senior bank facilities, high yield bond facilities, and lines of vendor credit. Created, maintained and restructured debt programs, operating environments, shareholder equity structures, vendor relationships, and bank facilities. Reviewed multiple financing structures to meet shareholder objectives including IPO, REIT spinoff, asset trust structures, and minority investments. Managed a large finance workforce over a widespread diversified region. Actively managed P&L performance and operating results. Created and implemented a corporate restructuring that included the downsizing of the workforce by nearly 30% and reducing annual SG&A expenses by $25 million. Managed shareholder relationships including large private equity groups to meet their financial objectives.

MR. JOSH JACOBS, Director

Jacobs is a highly accomplished technology executive with 30 years of innovation in digital media and advertising, sales and marketing, and strategic business and consumer product development. A noted pioneer in the programmatic media-buying industry, he has held senior level executive roles at several top technology companies on a global scale.

He most recently served in a number of leadership positions at Maven, a leading media platform for digital publishers. As president and executive chair,he led the company through the acquisition and integration of four media companies that included Sports Illustrated, Hub Pages, Say Media, and TheStreet featuring Jim Cramer.Within three years, Maven grew from a startup to a market leading platform serving over 110 million readers monthly and generating more than $100 million in revenue. He presently serves on the company’s board of directors.

Prior to Maven, Jacobs served as president of services at Kik Interactive, where he led the introduction of a developer and partner ecosystem powered by one of the world’s leading chat and messaging platforms. Earlier, he served as CEO of Accuen, an Omnicom agency, and president of platforms and partnerships for the Omnicom Media Group. He grew Accuen from a single office in Chicago into a global powerhouse, with a presence across more than 65 countries.

The Top 5 Reasons to Keep Your Eyes on Logiq Inc.

(OTCQX:LGIQ)

(NEO:LGIQ)

Logiq Inc. (OTCQX: LGIQ) (NEO: LGIQ) blew away 2021 Q4 earnings by almost 40%. (1)

It’s well-positioned to help small & medium-size businesses thrive in the $6.5 trillion e-commerce and mobile commerce industry.

LGIQ is showing heavy insider buying. (7)

CEO Brent Suen stated the company has plans to up-list from the OTCQX Exchange to the NASDAQ. (6)

The company estimates revenue growth to reach as high as $75 million at the end of 2022. (4)

Resources:

Source 1: https://finance.yahoo.com/news/lgiq-logiq-preannounces-q4-revenues-121000108.html

Source 2: https://www.trade.gov/ecommerce-sales-size-forecast

Source 3: https://www.emarketer.com/content/amazon-dominates-us-ecommerce-though-its-market-share-varies-by-category

Source 4: https://logiq.com/ir/corporate-profile/

Source 5: https://www.globaldata.com/indonesias-hot-drinks-market-reach-us3-1bn-2025-forecasts-globaldata/

Source 6: https://youtu.be/zsP_iPAggic

Source 7: https://simplywall.st/stocks/us/software/otc-lgiq/logiq

Source 8: Investor Presentation (Designer- see Trello card for investor deck LGIQ on Creative Projects (Landing Pages/Ads/Projects) | Trello)

Source 9: https://tinyurl.com/yckndc8a

Source 10: https://tinyurl.com/99em7e8u

Source 11: https://tinyurl.com/mvc7bjep

Source 12: https://tinyurl.com/2p83wed6

Source 13: https://www.weyland-tech.com/2020/09/22/logiq-on-track-for-record-revenues-in-2020-exceeding-38-million/

Source 14: https://tinyurl.com/35fkj3mc

Source 15: https://logiq.com/2021/10/13/how-to-use-context-in-your-ad-buys-to-reach-better-customers/

Source 16: https://www.globenewswire.com/news-release/2021/03/30/2201539/0/en/Logiq-Acquires-Rebel-AI-to-Bring-E-commerce-Growth-to-Brands-and-Agencies.html

Source 17: https://datareportal.com/reports/digital-2021-october-global-statshot